This 2025 assessment is designed to equip corporate innovation leaders and strategic decision-makers with up-to-date, actionable insights into the rapidly advancing landscape of rechargeable battery technologies. By focusing on recent technological advances, commercialization trends, and emerging market opportunities, it supports informed decision-making in a sector that is scaling rapidly and gaining strategic importance. Rechargeable batteries, core to industries from portable electronics and backup power to electric mobility, grid-scale storage, and industrial electrification, are experiencing accelerated adoption driven by renewable integration, grid flexibility, supply chain resilience, and decarbonization goals. In 2025, innovations in chemistry, manufacturing, and integration enable reliable, low-carbon energy systems, while a maturing industry sees diverging chemistries: established lead-acid (PbH) and nickel-metal hydride (NiMH) technologies persisting in cost-sensitive automotive starting and backup power applications; lithium-iron-phosphate (LFP) dominating mass-market EVs and stationary uses for its safety and longevity; nickel-rich (NMC) prioritizing energy density in portables and premium EV segments; sodium-ion (Na-ion) targeting abundance-driven niches against entry-level LFP and lead-acid; and solid-state lithium technologies nearing initial commercialization with superior density and safety. Amid structural price declines, fueled by scale-up, competition, and regional advantages, cost differentiation by chemistry, application, and geography is widening, reinforcing rechargeable batteries' indispensable role in a sustainable, resilient energy future.

Background

The landscape of rechargeable battery technologies has evolved significantly over more than a century of battery development. Despite these advances, however, the dominant rechargeable technology for much of this time had remained the conventional lead-acid (Pb-H) battery. It wasn't until the late 20th century that a new technology, offering superior specific energy capacity and a longer lifespan, paved the way for the emergence of mobile devices: Nickel-Metal Hydride (NiMH) batteries, introduced in the late 1980s. This marked a pivotal shift in energy storage, enabling the portability and functionality of early mobile technology. Soon after, in the early 1990s, Lithium-ion (Li-ion) technology was commercialized, and by 1991, it began to take its place in the market.

The lead-acid (Pb-H) battery has only recently given up its position as the dominant rechargeable battery technology in the field, still ruling over the low-cost and critical infrastructures backup segment, installed in most internal combustion cars and being the widespread solution for off-grid energy storage in remote areas. Standard Pb-H batteries are being utilized in the automotive sector, while deep cycle Pb-H batteries for storage applications are divided into flooded (FLA) and valve-regulated (VRLA) batteries, which consist of Absorbed Glass Mat (AGM) and Gel (GEL) types. It is however clear that the dominance of Pb-H batteries in the automotive segment are coming to an end with the rapidly expanding EVs, but there it is still the solution of choise for low-cost backup, critical infrastructures and offgrid applications.

Nickel-metal hydride (NiMH) technology remains the third most widely utilized rechargeable battery solution, valued for its reliability, safety, and moderate energy density. It is still commonly found in a variety of mobile devices and consumer electronics, such as cordless phones, cameras, and some medical equipment, where its long cycle life and durability are advantageous. However, despite its past use in hybrid vehicles, NiMH has largely fallen out of favor among electric vehicle (EV) and energy storage system (ESS) manufacturers. This decline is primarily due to the rise of lithium-ion batteries, which offer significantly higher energy density, faster charging times, and better scalability for modern applications like EVs and grid storage. Several other rechargeable (secondary) battery technologies are commercialized, but are not considered competitive for mainstream applications. Those niche technologies include the outdated Nickel-Cadmium (NiCd) and rarely utilized Sodium-based molten salt, Nickel-Zinc (NiZn) and Silver-Zinc (AgZn).

Throughout the 1990s, manufacturing of both NiMH and Li-ion batteries expanded rapidly to meet the growing demand for portable power. However, by the early 2000s, Li-ion technology had decisively emerged as the dominant solution, outpacing NiMH in terms of energy density, charging efficiency, and overall performance. This victory for Li-ion technology not only solidified its place in the mobile device market but also sparked the transition to electric vehicles (EVs) and provided a key enabler for stationary energy storage systems. As a result, Li-ion technology has been instrumental in shaping the current landscape of rechargeable batteries, fueling the widespread adoption of electric mobility and renewable energy storage.

Li-ion dominance

Li-ion technology is the undisputed leader in the mobile device world and is increasingly penetrating the automotive sector, serving as the key component of plug-in electric vehicles (EVs) and distributed electricity storage systems. By the early 2020s, Li-ion technology surpassed lead-acid batteries in terms of manufactured capacity and became the most dominant battery type globally. While several variants of Li-ion technology are currently available on the market, the chemistry has evolved over time. Initially, Lithium Cobalt Oxide (LCO) cathode electrodes were used, but they have since been replaced by other materials such as Lithium Manganese Oxide (LMO), Lithium Iron Phosphate (LFP), Lithium Nickel Manganese Cobalt (Li-NMC or simply NMC), Lithium Nickel Cobalt Aluminum Oxide (Li-NCA or simply NCA), Lithium Titanate (LTO), and more recently, Lithium Silicon (Li-Si) and Lithium Sulfur (Li-S).

Though these chemistries differ in their specific formulations, they are not fundamentally different from one another, with variances mainly in the lithium-containing cathodes and electrolyte composition, coupled with differing anode types. These variations result in slightly differing power outputs and energy densities. As a result, the growth of the Li-ion battery industry has been accompanied by a parallel expansion in mining and processing enterprises, which primarily focus on producing high-grade lithium carbonate, and to a lesser extent, lithium chlorate and lithium hydroxide. Importantly, it is clear that the future of Li-ion battery technologies will be dominated by cadmium-free chemistries such as the already-commercialized LTO and LFP, along with newer entrants like Li-Si and possibly Li-S. LFP technology has recently emerged as the market-leading Li-ion cathode technology due to its improved safety, longer lifespan, and more cost-effective production, making it particularly attractive for applications such as energy storage systems and lower-tier electric vehicles.

Emerging battery chemistries

Sodium-ion (Na-ion) and Potassium-ion (K-ion) battery technologies, long subjects of research, are making significant strides toward commercialization. Sodium-ion batteries, in particular, show promise as a cost-effective alternative to traditional lead-acid batteries for low-cost energy storage applications. These batteries leverage the abundance and low cost of sodium, making them attractive for large-scale storage systems where affordability is crucial. Advances in materials science and manufacturing processes are addressing challenges such as energy density and cycle life, bringing Na-ion batteries closer to mass-market viability. The development of K-ion batteries, while at an earlier stage, also holds potential for certain niche applications, thanks to potassium’s unique electrochemical properties. In the EV sector, manufacturers are beginning to explore hybrid battery solutions that combine lithium-ion (Li-ion) and sodium-ion technologies in a single pack. This approach could help reduce the overall cost of EV batteries by replacing some lithium-based cells with sodium-based ones, offering a balance between performance and affordability.

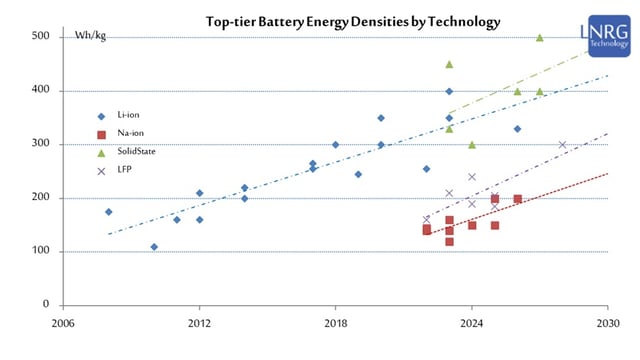

Lithium-based solid-state batteries are also advancing rapidly toward commercialization, promising higher energy density, improved safety (due to non-flammable solid electrolytes), and faster charging compared to conventional lithium-ion batteries. Major players like Toyota, Factorial Energy (in partnership with Stellantis and Mercedes-Benz), QuantumScape, and Solid Power have demonstrated prototypes with energy densities exceeding 375 Wh/kg, extended cycle life, and real-world testing in demonstration fleets as of 2025. While mass production is targeted for 2027–2030 by several automakers, pilot lines and partnerships are accelerating progress, positioning solid-state technology as a key enabler for longer-range, safer electric vehicles.

Rechargeable Batteries at an Inflection Point

Although lithium-ion (Li-ion), lead-acid (Pb-H), and nickel-metal hydride (NiMH) technologies remain prominent, the rechargeable energy storage landscape in 2025 is marked by accelerating innovation and shifting economics. Established Li-ion chemistries continue to evolve, with improvements in materials, electrode design, and cell architectures enhancing performance and specific energy. Increasingly, however, rechargeable battery technologies are diverging by application rather than converging toward a single optimal solution. Lithium-iron-phosphate (LFP) has emerged as the preferred low-cost, long-cycle option for mass-market electric vehicles and stationary storage, while nickel-manganese-cobalt (NMC) chemistries continue to serve higher-end EVs and portable electronics where energy density remains a priority. In parallel, sodium-ion (Na-ion) batteries are carving out a cost-driven niche, targeting applications where low price, material abundance, and safety are more critical than energy density, with the explicit aim of competing with lead-acid and entry-level LFP systems. At the same time, next-generation technologies such as solid-state lithium cells are closing to commercialization, promising higher energy density, improved safety, and extended cycle life, though initial deployments are likely to focus on low-power applications.

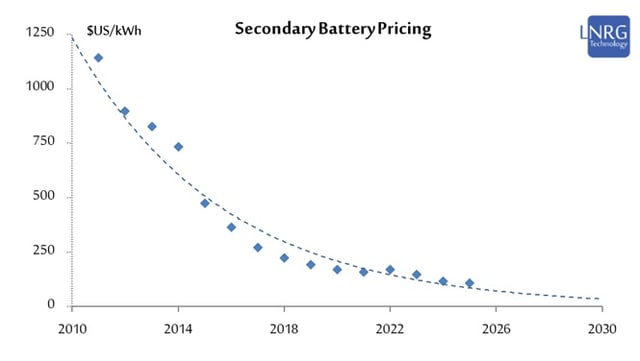

There are indications that battery pricing in 2025 is not only declining, but also becoming more structurally differentiated by chemistry, application, and region. Average Li-ion battery pack prices continued to fall despite rising metal costs, underscoring the impact of manufacturing scale, intense competition, and ongoing overcapacity. At the same time, price dispersion is widening: lower-cost LFP packs are pulling further away from NMC-based systems, reinforcing LFP’s position in cost-sensitive segments, while higher-energy NMC chemistries remain concentrated in premium EV and portable applications. A similar divergence is emerging between end markets, with stationary storage now achieving significantly lower pack prices than electric vehicles, reflecting simpler system requirements and the growing use of long-cycle, cost-optimized chemistries. Regional differences are also becoming more pronounced, with China consistently reporting the lowest battery prices globally due to its manufacturing scale, vertically integrated supply chains, and export competitiveness.

Together, these trends point to a maturing battery industry in which specialization, scaling, and regional advantages are enabling continued cost reductions even under raw material pressure. As battery technologies advance along increasingly distinct performance and cost pathways, further declines toward and potentially below the $50–$60/kWh range remain plausible over the medium term. This evolution reinforces rechargeable batteries’ central role in large-scale electrification, reducing the cost of electric mobility and energy storage, and accelerating renewable energy integration at grid scale, while continued innovation in chemistries, supply chains, and manufacturing processes remains essential to sustain performance gains and broaden commercially viable applications.

Access the latest battery pricing and specific energy density forecasts, along with insights into leading innovative battery companies driving advancements in rechargeable battery technology, available now at the LNRG Technology digital store.

Write a comment