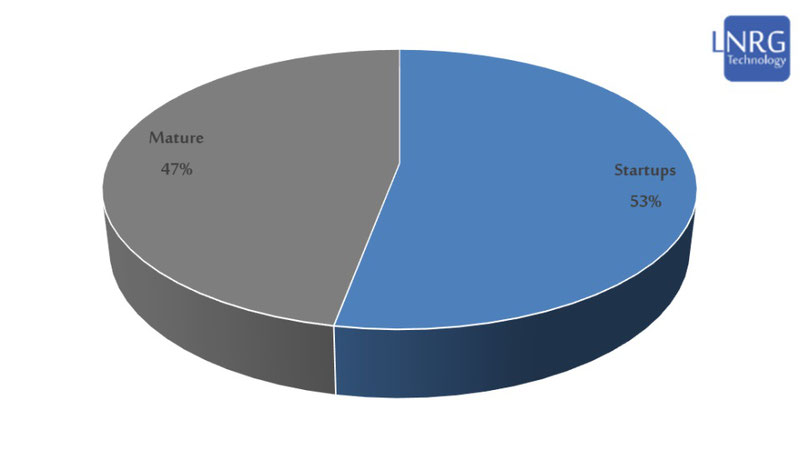

This market survey identified 85 Israeli civilian drone technology companies including providers of UAVs & Platforms, Drone Systems, Anti-Drone solutions, Passenger Drones and Drone Aftermarket products. Out of surveyed civilian drone technology companies, a remarkable 53% are startups – actively operating privately-held companies established within the past decade, which have yet reached an IPO or underwent M&A; the rest 47% are mature companies, including publicly traded ones. In addition, there are 14 Israeli companies which develop and manufacture military purpose drones, mostly mature companies.

Over the past decade, we have witnessed the rising phenomenon of electric drones (EDs) also referred as multi-copters or unmanned aerial vehicles (UAVs), available at competitive prices on the market. Drones have become to be viewed as a truly disruptive element within multiple areas of industry and services over a fairly short period of time. The growth in drone sales has grown exponentially, which implies their increasing penetration into existing drone markets of photography, security and recreation and more importantly drone integration into industrial areas. Moreover, drones have become an integral part of the modern battle field, driving armies to change strategies and technological orientation.

In terms of legal status, most of the civilian drone technology companies in this survey were found to be privately-held limited companies, with fewer being subsidiary limited companies and public companies. Though, a number of Israeli governmental, public and private companies specifically manufacture military drones, those were excluded from the below statistical analysis, while listed separately in the appendix. Out of surveyed civilian drone technology companies, a remarkable 53% are startups – actively operating privately-held companies established within the past decade, which have yet reached an IPO or underwent M&A; the rest 47% are mature companies, including publicly traded ones.

Overall, Israeli civilian drone technology providers can be classified into five main categories or subsectors: UAVs & Platforms, System components and technologies, Anti-drone technologies, Drone Aftermarket solutions and Passenger drones. It should be mentioned that several companies have developments in more than one segment, but are classified according to their main product emphasis.

In terms of civilian technology focus per above classification, the 2023 survey identified 24 active companies (28%) producing UAVs & Platforms, 41 companies (48%) having drone Systems expertise, 10 companies (10%) developing Anti-drone solutions, 8 companies (9%) targeting Aftermarket drone applications and 2 companies (2%) developing Passenger drone technology. In conclusion, Israeli drone technology ecosystem seems to be currently excelling in providing system components, as well as end-user UAV products and platforms. In addition, there are 14 Israeli companies which develop and manufacture Military Purpose drones, mostly mature companies.

The extended commercial report can be purchased at the LNRG Technology digital store.