This survey brings the 2022 comparative progress map of innovative rechargeable battery technologies, with a commercialization status of each technology. The analysis is aimed to assist corporate innovation managers and empower strategic decision makers towards future market developments in the energy storage sector. Rechargeable batteries, encompassing secondary electrochemical cells, have a profound role in multiple industries and hold the potential to become a disrupting element for future infrastructures. The market of rechargeable batteries is rapidly expanding, fueled by the growing utilization of rechargeable cells and packs in portable electronic devices, electric mobility solutions, grid energy storage and also a growing use within the general industry.

The landscape of rechargeable battery technologies has changed a lot over more than a century long era of batteries. However, the mainstream rechargeable battery technology has actually remained the same - the conventional lead-acid battery. Only towards the end of the 20th century another technology with superior specific energy capacity and longer lifetime allowed the emergence of mobile devices: this was Nickel Metal Hydride (NiMH) technology in late 1980s. Shortly after that, the Lithium-ion (Li-ion) technology became commercialized, entering the market in 1991. During the 1990s, both NiMH and Li-ion manufacturing had been aggressively expanded. However, by the early 2000s, the Li-ion technology emerged as the winner of this competition, taking over the mobile device market and consequently fueling the Electric Vehicle (EV) transition and stationary electricity storage.

Interestingly, the lead-acid (Pb-H) battery is still the most dominant rechargeable battery technology in the field, ruling over the automotive sector via a low cost lead-acid accumulator installed in most internal combustion cars and being the most widespread solution for off-grid energy storage in remote areas. Standard lead-acid batteries are utilized in the automotive sector, while deep cycle lead-acid batteries for storage applications are divided into flooded (FLA) and valve-regulated (VRLA) batteries, which consist of Absorbed Glass Mat (AGM) and Gel (GEL) types. It is however clear that the days of Pb-H batteries dominance is coming to an end with rapidly expanding Li-ion production and possible low cost environmentally friendly alternatives.

The Li-ion technology is an undisputed leader of the mobile device world, increasingly penetrating the automotive sector as the key component of plug-in electric vehicles and distributed electricity storage. Li-ion technology is expected to surpass lead-acid in terms of manufactured capacity during the 2020s and become the most dominant battery type. Though there are several variants of the Li-ion technology on the market, the chemistry of Li-ion has shifted over time from Lithium Cobalt Oxide (LCO) cathode electrodes to Lithium Manganese Oxide (LMO), Lithium Iron Phosphate (LFP), Lithium Nickel Manganese Cobalt (Li-NMC or simply NMC), Lithium Nickel Cobalt Aluminum Oxide (Li-NCA or simply NCA), Lithium Titanate (LTO) and recently Lithium Silicon (Li-Si) and Lithium Sulfur (Li-S). Most Li-ion chemistries are not principally different, with some variance of Lithium-containing cathodes and electrolytes coupled with a number of anode types achieving slightly differing power and specific density figures. As such, the growth of the Li-ion battery industry would require a parallel expansion of mining and processing enterprises – mainly targeted on producing high-grade Lithium carbonate and to a lesser degree on Lithium chlorate and Lithium hydroxide. It is also clear that the future chemistries of Li-ion would be dominated by Cadmium-absent technologies such as already commercial LTO and LFP, as well as recently commecialized Li-Si and possibly Li-S.

NiMH technology is still the third most utilized rechargeable battery solution, embedded in numerous mobile devices, but largely abandoned by EV manufacturers. Several other rechargeable (secondary) battery technologies are commercialized, but are not considered competitive for mainstream applications. Those niche technologies include the outdated Nickel-Cadmium (NiCd) and rarely utilized Sodium-based molten salt and Silver-Zinc (AgZn). Interestingly, the long researched Potassium-ion (K-ion) and Sodium-ion (Na-ion) battery technologies are progressing towards commercialization, with Na-ion potentially offering an interesting alternative for the outdated Pb-H technology for low-cost electricity storage applications. In addition, some EV manufacturers are beginning to explore the idea of combining Li-ion with Na-ion battery packs to lower EV battery pricing.

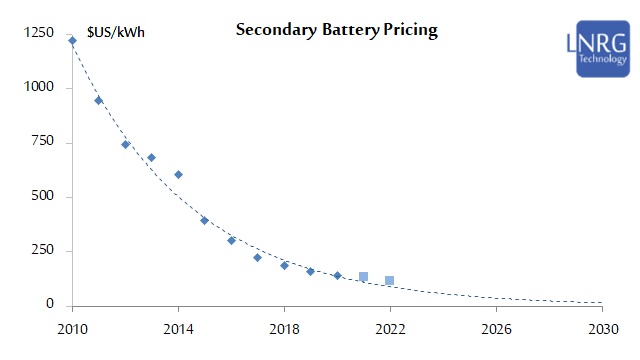

Despite the seeming dominance of lead-acid, Li-ion and NiMH technologies, there are quite several developments ongoing in the forefront of battery commercialization. First of all, batteries are getting better: Li-ion technologies are pushing the upper boundaries of specific capacity beyond 300 Wh/kg, while advanced research is ongoing on solid state battery solutions. Despite the surging prices of Lithium resources, the projected increase of specific capacity means that less lithium would be required for the same battery capacity. The pricing crunch in the Lithium industry might continue for some time, but in a sense this is similar to what happened to crystalline silicon prices in the solar photovoltaic industry a decade ago. It is most probable that the exponential decline of battery pack cost per kWh to continue and descend well under $US100/kWh per pack in the second half of this decade.

Obtain updated battery pricing and specific energy density projections, including an overview of top five innovative battery companies which push the limits of rechargeable battery technologies at LNRG Technology digital store.