When Avis Budget Group stock collapsed 26% on February 24, it was largely linked to the earning warning of the company for 2016, but it is not the whole story. It is notable that the Avis Budget Group stock wore the deep red color despite the fact that the company stood up to analyst expectations of adjusted Q4 2015 earnings per share and even showed a 1% increase in its quarterly sales. Though the shares of Avis Budget Group could somewhat recover over the last trading days of February from their two-year low of 22.04 Dollars-per-share on February 24, there is now little optimism over Avis Budget Group shares among analysts. So what did really go wrong with Avis Budget Group on February 24 and what is the reason behind the crisis of the entire car rental industry?

Avis Budget Group (NASDAQ:CAR) is a giant in the global car rental business and its performance is a mirror to the entire industry. Despite the general stability at the stock market, the car rental industry has sustained a severe impact during the past 18 months. Avis Budget Group has been reduced from all-time record 69.52 Dollars-per-share on 18 August 2014 to as low as 22.04 Dollars-per-share on 24 February 2016 - a 68% decline, while the Nasdaq Composite Index has remained practically flat during this period. This crisis has not spared other car renting companies - Hertz (NYSE:HTZ) for instance has dropped a whopping 78% from its record on August 2014 to its recent low on February 2016. One of the reasons for the above described harsh decline of car rental shares is perhaps the lack of dividend history in this industry, but this is a partial explanation for the extreme volatility and not one of the reasons. An interesting correlation showing between the car rental business and the general crisis of the energy industry, induced by the collapse of oil prices, but the question is how come those two are positively correlated, as seemingly the decline of gasoline prices should have actually reduced rental companies' operational expenses.

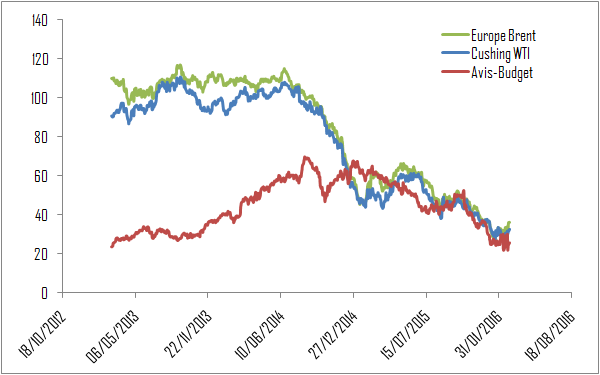

As already mentioned, the causes for the car rental business crisis are extending much beyond the "earning warning" of Avis Budget Group on February 2016. We can herewith trace the beginning of Avis Budget's downtrend to September 2014 - close to the beginning of the recent oil crisis. There is however still some discrepancy, as the oil began its downturn in July 2014, while car rental companies had waited for September that year to stop rising and the actual continuous decline began only in January 2015. Moreover, despite the recent stabilization in oil prices, with decade lows recorded in January 2016, the shares of car rental companies went on with the downtrend all the way into February 2016, showing just a minor recovery in the last week of that month. Still, there is certainly a correlation and the feasible explanation is that despite the decreasing cost of gasoline for rented cars of Avis and Budget and of course also decreased operations costs in ZipCar, the reduced price of gasoline has in fact driven customers away from rented cars, ,making them to give preference to their own vehicles due to the sudden and radical reduction of gasoline prices. Despite this seemingly obvious connection, there is also another factor, which is possibly involved in driving investors away from car rental companies and this is the ongoing smart mobility revolution.

Figure 1. Avis Budget shares vs the price of Cushing WTI oil and Europe Brent (data from EIA and Nasdaq) - the correlation appears high only during the last year.

Though this is of course a hypothesis to be verified in the future to come, it is very much possible that in addition to oil price volatility, the aggressive entrance of ride-sharing companies into the private transportation arena could also be a disruptive element in the metropolitan transportation market, pressing down the shares of car rental companies. In case we do see a continuing recovery in the oil market, in parallel with a continuing slide of car rental shares, the answer would be clear. What is meanwhile going on is that the traditional means of transportation in metropolitan areas are radically changing and we can see an emergence of new transportation models and of course emergence of new companies, such as Uber, Sidecar and Lyft, in line with potential game-changing contestants such as Google with its novel Waze Rider service. It is interesting to note that Avis Budget did have a good feeling in the direction of smart mobility, acquiring ZipCar - a provider of car-sharing via rent, but it seems that the car-pooling (ride-sharing) concepts could have a much more rapid penetration into metropolitan transportation systems, effectively altering the existing transport systems and claiming customers from car-rental companies.

So the ride-sharing companies could potentially threaten the car rental business in the eyes of investors, but we don't really see such an effect in the last quarterly report of Avis Budget, which in fact shows stability in sales. What we do however know is that the taxis are suffering a very heavy impact. For instance according to the San Francisco Municipal Transportation Agency (published September 2014), taxi use had tumbled by 65% from March 2012 to July 2014. While taxi companies are not traded at the stock exchange, a relative business of car rental does and indeed in summer 2014, Avis Budget and Hertz shares have begun a wild downturn. In late January 2016, the largest yellow cab company of San Francisco name Co-Op filed for bankruptcy. Though the cab company specified passenger legal suits as the main cause for their demise in the official statement, it is clear that ride-sharing companies have had a major role in this.

The transportation sector is changing and though it is not clear what the future will bring, we can be certain that conventional models are under an existential threat. The car-sharing and ride-sharing models are just two parts of the puzzle of future transportation, where disruptive technologies, such as autonomous vehicle and electric two-wheel transport concepts, are pushing ahead to threaten the conventional means of transport such as trains, buses, taxis, private four-wheel vehicles and seemingly even rented cars.